Yesterday I went out on a limb predicting that SAP’s new On-Demand mid-market offering, codenamed A1S will be a game-changer. ZDNet quoted my conclusion:

My bet is on SAP: they may stumble a number of times, which will effect their quarterly numbers – but in the end, I believe they will succeed. They will become the dominant SaaS player in the mid-market, forcing smaller players like NetSuite down-market. In the next 2-3 years while SAP flexes their On-demand muscles, we’ll see just how pervasive SaaS proves in the large corporate market, and that will determine whether A1S remains a midmarket solution or becomes the foundation of SAP’s forey into that market – their natural home base.

This was the day before the announcement. This morning my fellow Enterprise Irregulars jokingly asked: “Has the world of Enterprise Software really changed?’ We did not know the answer than, but now we do: Yes. SAP Business ByDesign is really a game changer. Key reasons:

This was the day before the announcement. This morning my fellow Enterprise Irregulars jokingly asked: “Has the world of Enterprise Software really changed?’ We did not know the answer than, but now we do: Yes. SAP Business ByDesign is really a game changer. Key reasons:

- Breadth of functionality

- Fixed, Trasnparent pricing (which, I might add will put the squeeze on Salesforce.com ad NetSuite)

- All this coming from SAP, the recognized leaders in automating business processes.

I will soon have more details, but suffice to say the Enterprise Irregulars contingent here came to the same conclusions. Here are the initial reactions:

ZDnet/Software, Rough Type, Redmonk, Computerworld, WSJ.com, ZDNet/IT Project Failures, The Ponderings of Woodrow, ZDNet/Software as a Service, Between the Lines,

Photo: the Enterprise Irregulars with Henning Kagermann, SAP CEO. Credit: Prashanth Rai

For half an hour or so I felt I was back at University at Software 2007 – in Professor Hasso Plattner’s class. That’s because his keynote was a compressed version of his recent SAPPHIRE 07 speech, which in turn was an “offsite class” for his Stanford students – literally so, he flew the entire class out to Atlanta. To make his point, he used the blackboard-metaphor, with chalked handwriting (and dressed in matching black

For half an hour or so I felt I was back at University at Software 2007 – in Professor Hasso Plattner’s class. That’s because his keynote was a compressed version of his recent SAPPHIRE 07 speech, which in turn was an “offsite class” for his Stanford students – literally so, he flew the entire class out to Atlanta. To make his point, he used the blackboard-metaphor, with chalked handwriting (and dressed in matching black ).

).

He is not a product-pusher, not a marketer: he sets direction for several years ahead.

He is not a product-pusher, not a marketer: he sets direction for several years ahead. Way back at the Office 2.0 conference

Way back at the Office 2.0 conference

Yugma

Yugma

24SevenOffice

24SevenOffice

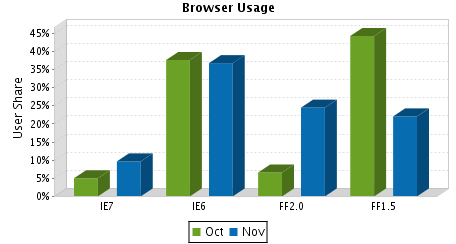

). Clearly, the majority of new IE7 users are not IE6 upgraders, they came from the Firefox camp.

). Clearly, the majority of new IE7 users are not IE6 upgraders, they came from the Firefox camp.

Recent Comments