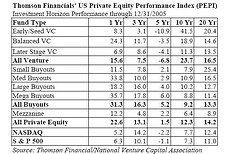

Will Price comments on the recently released Venture Capital Performance data.

Will Price comments on the recently released Venture Capital Performance data.

In a sepearate post he discussess how startup Board Meetings are often nothing more than status updates. These meetings should focus on decision making, which of course would require previous analysis and presentation of options by the CEO. Will concludes the CEO’s credibility, the Board’s trust in the Management team largely depends on this more proactive approach. My 2cents: Board Members should not hear about major issues/problems at the meeting for the first time, they should be informed prior to the meeting, on an ongong basis. Every board should have a wiki which should become the continuous communication channel between the CEO and the Board, and a way to collaboratively prepar decisions prior to the meeting.

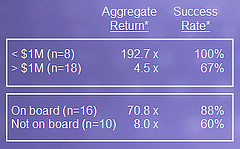

Talk about investment performance and Board participation, this chart by Paul Kedrosky of Vinod Khosla’s seed investments is quite amazing. His very early investments under $1M (an amount most VC’s won’t even consider) yielded far better returns than larger investments – and as for 100% success rate??? Wow!

Talk about investment performance and Board participation, this chart by Paul Kedrosky of Vinod Khosla’s seed investments is quite amazing. His very early investments under $1M (an amount most VC’s won’t even consider) yielded far better returns than larger investments – and as for 100% success rate??? Wow!

As if to illustrate the above case, Fred Wilson discusses why smaller upside deals often don’t get funded as they wouldn’t “move the needle” for larger VC funds. He doesn’t like making decisions on this basis, since “it can cause you to leave good opportunities on the table for others if you aren’t careful.” “We prefer to think about the end markets we want to be involved in, the people we want to work with, and efficient market entry strategies and let the needle moving problem take care of itself for the most part.” Small is beautiful, after all.

Angels tradtionally do both – small and very early stage. Jeff Clavier quotes a VC Experts newletter, that classifies angel investors according to several criteria, but largely based on their operational experience and level of participation. “Based on these definitions, I guess that I am between the Serial and the Trailblazer”

Ed Sim writes about how hiring a VP of Sales too early can be a fatal mistake for a startup – I have some fairly srong opinion and a case study on the subject, which I hope to be able to post soon. In the meantime, Ed’s previous piece on Top-heavy Teams and Dharmesh Shah’s piece on why sartups Don’t Need A World-Class Management Team are must-reads.

Rick Segal looks at another typical trap startup Founders find themselves in: not getting truly critical feedback, if they mostly ask their friends, telling about their own idea. He set up an experiment at Gnomodex, asking people about a fairly lame idea. When he presented it as his own, “the worst feedback I got was “a bit narrow of a solution, don’t you think”.” He then asked another group of people, presenting it as someone else’s idea, and the feedback was honest and brutal. “Same idea, same basic pitch, same request. The difference being that I set up an environment where it wasn’t personal and the feedback could flow without the perceived or real fear of offending me. It didn’t matter if these were friends or people I had never met before.” So apply the Kool-Aid Test, present the idea as one you heard about.

Oh, No! David Hornik promises to write shorter posts. David, you really shouldn’t. You write less frequently, but always have good original thoughts, that are mor like essays – don’t cut it down!.

So you thought Google was a search… advertising … software … information …etc. company? Well, you’re in for a surprise:

So you thought Google was a search… advertising … software … information …etc. company? Well, you’re in for a surprise:

Recent Comments