Some commenters on TechCrunch are asking the usual question: what’s the business model? I think it’s obvious: Ziki has commission-based deals with sunglass-manufacturers.

Some commenters on TechCrunch are asking the usual question: what’s the business model? I think it’s obvious: Ziki has commission-based deals with sunglass-manufacturers. ![]() If you visit the site, you’ll see it yourself – but not for long, your eyes will burn (sans shades).

If you visit the site, you’ll see it yourself – but not for long, your eyes will burn (sans shades).

On a more serious note: I will soon write about a truly innovative business model (by another company).

Update (4/24). Nobody else seems to have discovered the “secret deal” – they talk about Zikis social networking, tagging ..etc features.

- Ziki : people newsmaster

- Ziki – Finding People by Tag, Name or Web Address

- Zikified

- Ziki – Your Digital Life in a Box

Update (4/27): Ziki listens: they toned down the colors – there goes the sunglasses-deal ![]()

Tags: ziki, techcrunch, design, web-design, humor

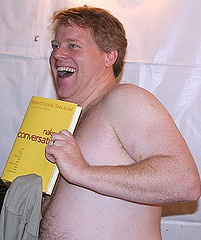

OK, let’s just all come clean. Blogging is a hoax. It’s just a cover to hide our primary business: selling our bodies. First Robert and Shel got

OK, let’s just all come clean. Blogging is a hoax. It’s just a cover to hide our primary business: selling our bodies. First Robert and Shel got  Then came Chris Pirillo, renting out his chest for 20 bucks… I have not seen his complete price list for other body parts, but check out his pix at

Then came Chris Pirillo, renting out his chest for 20 bucks… I have not seen his complete price list for other body parts, but check out his pix at

Recent Comments