Investments in Life Science companies are at an all-time high and with this sector poised to be the next Big Wave. Silicon Valley is riding high and emerging as the most innovative global BioCluster and convergence hotspot. What does this opportunity mean for Valley bioentrepreneurs? What are the key opportunities – and challenges? And how can Life Science Entrepreneurs capitalize on the BioWave?

These are some of the questions the panelists will discuss at SVASE’s BIG (Business Interface Group) event this Wednesday evening in Palo Alto. These people from the “trenches” will share the lessons they have learned in the process of founding companies; from concept to Series A and beyond into the markets and the (Wall) streets.

In addition, the event will feature a Technology Showcase, where entrepreneurs can showcase their technologies at table-top displays and deliver 4 minute pitches to the panel and audience.

The Panel:

Rich Ferrari, Denovo Ventures

Allan May, Life Science Angels

Elizabeth Holmes, President and CEO, Theranos, Inc

Dinesh Patel, President & CEO, Arete Therapeutics

Moderator – Frank Rahmani, Partner, Cooley Godward

For more information see the SVASE site. I am giving away 5 free tickets using this link, after which normal registration through the SVASE site is available.

The success of traditional conferences largely depends on the quality of the presentations: that’s not the case with the

The success of traditional conferences largely depends on the quality of the presentations: that’s not the case with the

Raw notes from the discussion with

Raw notes from the discussion with  New subject: Technology – what’s coming next? John Doerr: Biology. This is what he really wants to talk about, now he gets passionate. He talks about soon-to-debut “

New subject: Technology – what’s coming next? John Doerr: Biology. This is what he really wants to talk about, now he gets passionate. He talks about soon-to-debut “ Oh, boy, and I thought $85K was way

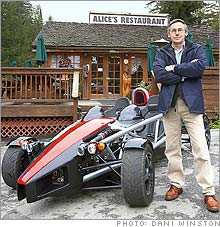

Oh, boy, and I thought $85K was way  The Flying (well, almost) Bug is street-legal, but he cannot fire up the jet… although “Patrick says that once in a while he puts on a crash helmet (mainly as a sound muffler), takes the car out on nearby Highway 237 in the wee hours of the morning and fires it up for a brief and hopefully cop-free run.”

The Flying (well, almost) Bug is street-legal, but he cannot fire up the jet… although “Patrick says that once in a while he puts on a crash helmet (mainly as a sound muffler), takes the car out on nearby Highway 237 in the wee hours of the morning and fires it up for a brief and hopefully cop-free run.” Update (5/9): See

Update (5/9): See

Recent Comments