This morning Zoho, known for SMB focused SaaS offerings in the areas of productivity, collaboration, business processes launched an Accounting app: Zoho Books. I typically don’t do detailed product reviews, when I see the first good ones, will link to them – just a few points here and then let’s discuss how it rounds out Zoho’s overall strategy.

The following video introduction is a bit “cutesy”:

-and that’s quite intentional. In fact simplicity is one of the key points in Zoho Books:

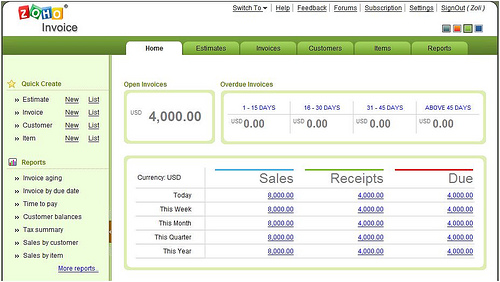

- Clear, streamlined UI, tabs, easy terminology –i.e. Money In, Money Out. This service is clearly targeted at non-accountants, which is most of us in a small business – hey, even I can understand most of it.

- That said, Books offers the opportunity to share data and collaborate with accountants (Ouch, did I really needed that reminder for tax time?;-) )

- Multi-currency support – this is typically a later add-on in many systems, but Zoho has a wide international presence with most of their other services

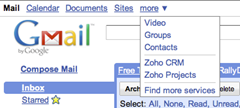

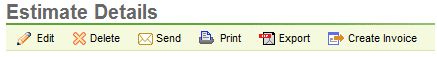

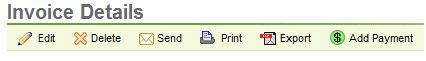

- Integration with Zoho CRM, Invoice, Mail – somewhat basic now, will be improved as we’ve seen with the rest of Zoho’s offerings

- Support for electronic payment systems like Paypal, Google Checkout, Authorize.net. This is a “hidden treasure” inherited from twin service Zoho Invoice, which is a subset of Book’s functionality and can be easily upgraded. Why hidden? Because relatively few know that Paypal offers 50 cent (yes, that’s $0.50 per transaction) Business Payments NOT available through the Web, only via their API, i.e. apps like Zoho Invoice and Boooks.

Having said that, is Zoho Books a Quickbooks killer?

(Cross-posted @ CloudAve » Zoli Erdos)

)

) Ben recently reported on how

Ben recently reported on how

. In fact let’s just stop here for a minute.

. In fact let’s just stop here for a minute.

.

.

Yes, the title isn’t a mistake: TechCrunch is no longer just powerful media, Mike now can single-handedly release new products.

Yes, the title isn’t a mistake: TechCrunch is no longer just powerful media, Mike now can single-handedly release new products.

Zoho, best known for their Web-based Productivity (Office+) Suite today released

Zoho, best known for their Web-based Productivity (Office+) Suite today released

Recent Comments