We’ve had email dead, resumes dead, wikis dead themes, now it’s apparently time for the SaaS is Dead meme, thanks to a recently published Gartner report. My favorite quote from the report:

We’ve had email dead, resumes dead, wikis dead themes, now it’s apparently time for the SaaS is Dead meme, thanks to a recently published Gartner report. My favorite quote from the report:

SaaS is not a panacea, and companies need to evaluate and understand the trade-offs that SaaS presents

Indeed. Here’s another quote from Gartner VP Rob Desisto:

If you’re a small business with no IT staff then the math is a lot easier. You need to buy the hardware. With a larger company, the math doesn’t always work out in favor of SaaS.

Now, where have I heard that before? Wait… I said it, 4 years ago:

…While it’s easy to declare that for small businesses without their own IT resources there is no better option than SaaS, there is no clear “winner” for large corporations. There shouldn’t be. This is not religion; it should be business decisions that these organizations have to make individually. Analysts fighting the SaaS vs. On-premise war often forget that software exist to resolve business problems. As Charles so eloquently points out, it’s the complexity of these business processes, the need for customization, the number of user seats..etc that matters, and as we move up on this scale, increasingly “traditional” Enterprise Software is the answer. I happen to believe that eventually SaaS will grow up to meet those requirements, but am not going to guess how many years it will take. In the meantime the SaaS-fans (admittedly I am one) can claim that SaaS is the future – but that does not mean Enterprise Software is dead.

OK, ego trip done, let’s look at some of the specific points that sparked a debate between Krish @ CloudAve and Ben Kepes:

The TCO Myth

Gartner argues that long term TCO of on-premise software can be lower for businesses that don’t upgrade often. Krish’s counterpoint is that businesses that stay on obsolete versions of their systems will fall behind competitors. Ben argues that many businesses are simply satisfied with their current system functionality and would derive little value from upgrades (well he refers to moving to SaaS, but that was not the original point by Gartner).

My take: sorry guys, it’s not so black-and-white. Yes, many businesses avoid software upgrades like the plague, but not necessary because they would not benefit from it: it’s all about avoiding the major cost and business disruption traditional Enterprise Software upgrades bring about. (As a background, I spent the 90’s selling and implementing SAP solutions. I still chuckle when I hear there are SAP consulting teams at my 1990-93 clients: the upgrade cycle never ends)

SaaS typically comes with more subtle and more frequent updates that don’t disrupt business. Now, let’s be fair: the SaaS market is still quite nascent, despite the fact that Gartner is ready to bury it. Our experience is with seemless Google and Zoho upgrades, or not-so-seamless but still not disruptive Salesforce.com, NetSuite ..etc upgrades. There is still nothing on the same magnitude of a SAP or Oracle Enterprise Suite, so we really do not have a lot of realistic comparison on that level…

For further details I suggest Ray Wang’s excellent piece on How To Compare Total Ownership Costs.

The Pay as You Use Myth

Gartner says the old enterprise practices are seeping into the SaaS market and we are seeing push for long-term, multi-year deals with upfront payments.

Krish argues that many enterprise customers actually prefer to pay long term to avoid the hassle of monthly billing, while Ben points out the root cause of the issue is SaaS vendors not having the right tools for more granular use-based billing.

Both are right, I don’t even see this a debate (?). Years ago I had been a NetSuite customer, and was given several choices, with multi-year contract carrying significant discounts. But still, the plans were mostly seat-based, with no chance to adjust downward and not enough flexibility to account for functions used / not used. But let me say this: a lot of what we’re saying today is just business decisions, SaaS providers have better technical bakcground to offer very granular, real-usage based pricing for two reasons:

- They can actually monitor what is being used (unique vs concurrent users, actual functions not just major modules)

- They can invoice accordingly – the systems are now available, and I think competition will push them t create the business framework.

Coincidentally, NetSuite just announced their integration with Zuora, the billing system for the subscription economy. This is an offering for subscription-based businesses who uses NetSuite – in other words NetSuite’s customer. Now, what I really wonder about is whether NetSuite will take this opportunity and consider themselves a customer / user of Zuora’s services: i.e. step up the plate and offer true usage-based subscription models – most likely as an alternative to the current ones.

The Shelfware Problem

No, for this to come up as a SaaS-specific problem is just pathetic. Shelfware is as old a concept as Software licencing: it’s the phenomenon of being locked in to more user seats and entire modules you don’t use, often without knowing about it. Here’s a choice quote from Gartner VP Rob Desisto again, although he used it in another context:

many organizations have CRM already because it was bundled with their ERP licenses

There is nothing inherent in the nature of SaaS that would promote shelfware, in fact as I‘ve just pointed out above, technically SaaS vendors have better ability to monitor actual usage than the major nightmare of software audits in the on-premise world. There are good initiatives, like RightNow promising to end shelfware, and I trust competition will lead to more of this.

Again, I offer two great pieces on the subject by Ray Wang:

The debate is on – feel free to chime in.

(Cross-posted @ CloudAve)

I’ve previously covered Netbooks, provider of an

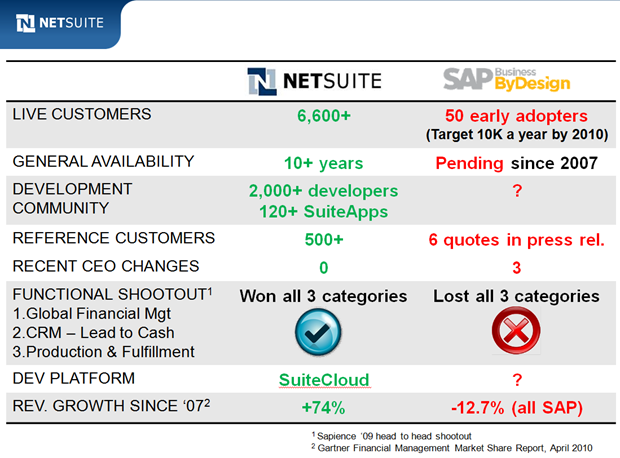

I’ve previously covered Netbooks, provider of an  John Wookey has a tough job. The former Oracle Exec, currently EVP @ SAP, the Enterprise Software leader is supposed to charter SAP’s foray into On-Demand – in a company whose bread-and-butter is clearly in installed applications and which still largely considers a threat to its traditional lucrative business.

John Wookey has a tough job. The former Oracle Exec, currently EVP @ SAP, the Enterprise Software leader is supposed to charter SAP’s foray into On-Demand – in a company whose bread-and-butter is clearly in installed applications and which still largely considers a threat to its traditional lucrative business.

![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/1e888c58c2f8097a76d183db620f05dd.png)

I don’t claim to be an expert economist, so

I don’t claim to be an expert economist, so  )

) On my personal blog I don’t have to be as politically correct as on CloudAve, so here’s my summary: they tried SaaS, could not crack it, so concluded the market as a whole did not matter – a strategic mistake.. or… well, as they say, a

On my personal blog I don’t have to be as politically correct as on CloudAve, so here’s my summary: they tried SaaS, could not crack it, so concluded the market as a whole did not matter – a strategic mistake.. or… well, as they say, a

Recent Comments