(Updated)

Fred Wilson doesn’t like Mike Arrington’s deadpool:

“So I have to shake my head at the resurrection of the dead pool, which was made popular last time around by Fucked Company. Do we really need to celebrate when companies fail?”

No, we don’t, and I don’t think TechCrunch does. Let’s be realistic: TechCrunch did not build this boom. Yes, a well-timed review helps a startup gain initial traction, but Mike does not make those companies successful: whether they make it or not, they do so on their own. And when they fail, they fail own their own merits, too. Failures are part of business reality, and reporting on them only makes TechCrunch balanced. Without it Mike would be just a biased cheerleader (something he was accused of in the past).

In fact Arrington’s latest post, Bubble, Bubble, Bubble is optimistic, despite the title:

“But this doesn’t mean we’re in a bubble. In fact, I think the exact opposite. I think a few failures are direct evidence that we are not in a bubble and that the private venture markets are actually in the process of letting off a little steam to keep things rational…

…I also disagree that too much money is chasing too few good ideas … Remember that VC’s business models are designed to fail most of the time – the majority of their investments are expected to go belly up, and they hope that just one or two out of ten have a big return…

…So every time a startup dies, I don’t think it’s evidence of a bubble about to burst. I think it’s evidence of a market that is working exactly as it should. Most companies fail, but enough win to keep the whole ecosystem healthy.”

This does not sound like deadpool celebration to me. Au contraire, it sounds like realistic, but still positive market assessment.

Most companies in the “deadpool” are/were way overfunded for what they do. They, and their investors did not follow the model outlined in Fred Wilson’s excellent article, Web 2.0 Is A Gift, Not A Threat, To VCs. A must-read, IMHO.

Update (1/8): Our little discussion made it to The New York Times.

I agreed to be on the Selection Committee for the next full-day

I agreed to be on the Selection Committee for the next full-day  Track – Time, Expenses, Budgets, Accounting, HR

Track – Time, Expenses, Budgets, Accounting, HR ) there are still a few days left for new submissions, so if you know a startup in the above categories, please recommend them either in a comment below or by

) there are still a few days left for new submissions, so if you know a startup in the above categories, please recommend them either in a comment below or by  We now have

We now have  I want it to happen without me ever worrying about – that’s exactly what some of the online backup services offer.

I want it to happen without me ever worrying about – that’s exactly what some of the online backup services offer.

Not mentioning

Not mentioning

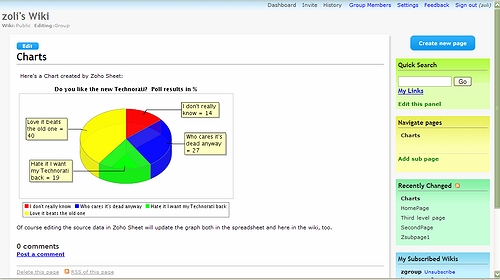

It’s nice to get your dream fulfilled fast. Writing about Socialtext 2.0 in October I wrote: “My ‘

It’s nice to get your dream fulfilled fast. Writing about Socialtext 2.0 in October I wrote: “My ‘

)

)

Recent Comments