Forget software: it’s all about (your) data.

Hyper-growing Financial Management system provider and Quicken / MS Money challenger Mint recently raised eyebrows announcing their plan to sell anonymized aggregate customer data. Some reviewers were screaming, we saw bombastic titles like Personal Finance Startup Mint Wants To Sell Your Money Trail – but in reality the news wasn’t earth shattering. You don’t really believe your spending patterns are not dissected – aggregated – analyzed in every possible way and sold by your bank and credit card company, do you?

So nothing new – but a good opportunity to discuss the role of user data in SaaS business models – and there is more than outright sale of data.

If you think this is yet-another post on Platform as a Service, you’re wrong. I’ll be talking about much simpler things here:

If you think this is yet-another post on Platform as a Service, you’re wrong. I’ll be talking about much simpler things here:

Startup Entrepreneurs who did not make it to the recent

Startup Entrepreneurs who did not make it to the recent  Quick update on the

Quick update on the

This will be an unusual post in more than one way.

This will be an unusual post in more than one way. The discount is quite deep, 100 points on the DOW is nothing percentage-wise, yet it earns a 10% discount on your tee-price. The company maximized the “DOW-insurance” program at 700 points, which would equate $35. Is this a funny way of declaring the true bottom price of $20?

The discount is quite deep, 100 points on the DOW is nothing percentage-wise, yet it earns a 10% discount on your tee-price. The company maximized the “DOW-insurance” program at 700 points, which would equate $35. Is this a funny way of declaring the true bottom price of $20?

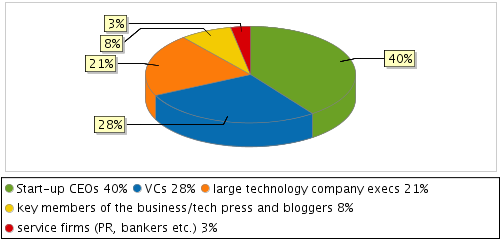

. Other than the presentations, these events are also an excellent networking opportunity amongst the 400 or so attendees, so let’s look at the previous years’ attendance statistics by provided by Dealmaker Media:

. Other than the presentations, these events are also an excellent networking opportunity amongst the 400 or so attendees, so let’s look at the previous years’ attendance statistics by provided by Dealmaker Media:

Recent Comments