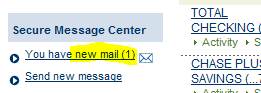

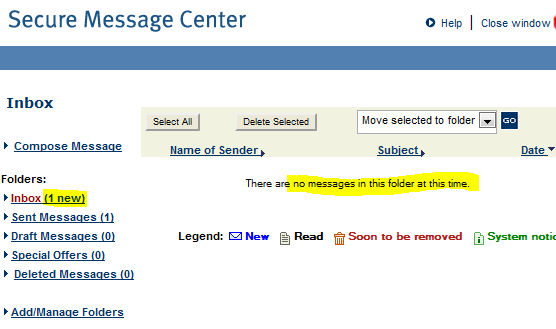

OK, that should be easy, let’s click to get that email:

Oops – dear Chase, where’s my message?

Of course on the week when the IMF and the US Senate gets hacked, GoDaddy goes down (did they forget to renew their domain?), I should not complain. After all, it’s not my money they’ve lost. (?)

(Cross-posted @ CloudAve » Zoli Erdos)

An era comes to an end on June 30th, when

An era comes to an end on June 30th, when  Email @ 9:20pm yesterday:

Email @ 9:20pm yesterday:

When it didn’t happen, they must have lost interest – the annual Money upgrades brought less and less new features or even bug fixes, and smart users started to skip releases between upgrades. Then trouble started left and right: weird things happened to my accounts beyond my control. Categorization? I’ve long given up on it, most of my downloaded data is associated with junk categories. The real bad part: data changed in existing accounts, very old transactions downloaded again into already reconciled months..etc. This is my bank account, my money we’re talking about! The very data I meticulously took care of while in my possession now got randomly changed. The only way to be really sure I have the right balances was (is) to go and verify them at the individual bank or broker sites.

When it didn’t happen, they must have lost interest – the annual Money upgrades brought less and less new features or even bug fixes, and smart users started to skip releases between upgrades. Then trouble started left and right: weird things happened to my accounts beyond my control. Categorization? I’ve long given up on it, most of my downloaded data is associated with junk categories. The real bad part: data changed in existing accounts, very old transactions downloaded again into already reconciled months..etc. This is my bank account, my money we’re talking about! The very data I meticulously took care of while in my possession now got randomly changed. The only way to be really sure I have the right balances was (is) to go and verify them at the individual bank or broker sites. ) and not even feel the need to apologize. It’s the absolute Cardinal Sin. And now this company wants me to put my trust in their services?

) and not even feel the need to apologize. It’s the absolute Cardinal Sin. And now this company wants me to put my trust in their services?

![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/c3f6a73b6f73860cb3967d8190b33e5c.png)

Blog Tracking Services Compromise Online Bank Security?

Is this a real danger? What do you think?

Update (11/19): Several commenters here and on TechCrunch confirm what I thought myself: the warning likely refers to “tracking” products that offer a browser plug-in. In this case I was using FireFox with the BlogRovr plugin turned on. I know coComment offers a plugin, and whoever else does … well, Citibank considers it a security risk. Hm… food for thought.

Update #2: Wow, apparently this has been a well-documented problem for at least half a year, so Citi’s solution is to finally put up a warning message.