I am a big fan of Software as a Service, but it frustrates the hell out of me to see industry pundits over-hype it without really understanding it. Here are 3 killer (in the bad sense) half-truths about SaaS:

1 – SaaS is simpler, easier to implement than On-premise software (see update at the bottom)

2 – SaaS is for the SMB market

3 – SaaS is bought, not sold, it’s the end of Enterprise Sales

Let’s examine them in detail:

1 – SaaS is simpler, easier to implement than On-premise software.

The only part that’s absolutely true is the technical installation, which the customer no longer has to worry about with SaaS. But we all know that this is a fraction of a typical implementation. Implementations are all about business process and training, hence the difficulty / duration / cost of an implementation depends on the complexity of business and the size of the organization – these two tend to correlate with each other.

It just so happens that all SaaS solutions so far have started (and many stay) at the SMB level, so they are simpler not by virtue of being SaaS but by their target market’s needs.

2 – SaaS is for the SMB market

Yes, traditionally all SaaS started with Small Businesses, but that does not mean it may not move upstream. Salesforce.com and several HCM applications have proven technical scalability, but they offer partial / departmental functionality.

I am a strong believer that in 4-5 years most software developed will be SaaS, and that in 10 years it will be the predominant method of “consuming” software by large enterprises – but I can’t prove it. There’s no empirical evidence, since there has not been any Integrated Enterprise SaaS available so far. The closest to it is NetSuite today (but it’s still SMB focused), and SAP’s Business ByDesign tomorrow. In fact despite SAP’s official positioning, driven by market focus and current limitations (functional and infrastructure), I believe that SAP will use BBD to learn the SaaS game – i.e. BBD will be a test bed for a future Enterprise SaaS offering. But we’re not there yet.

(longer discussion here)

3 – SaaS is bought, not sold, it’s the end of Enterprise Sales

Hey, I’ve said this myself, so it must be true (?). Well, it depends on the position of the sun, the constellation of the stars, and several other factors, but mostly the first two we’ve just covered.

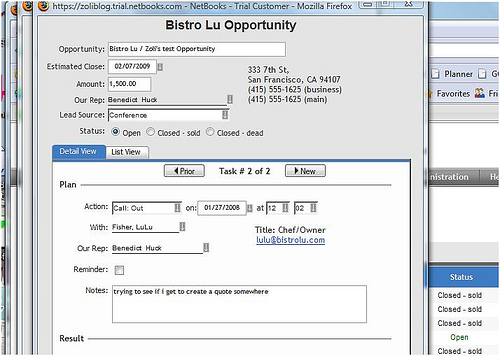

SaaS for very small business: that’s the clear-cut lab case for the click-to buy pull model to work. In fact in this respect (sales model) I believe the business size is the no.1 determinator. Some solutions will have to be configured and may even require pre-sales business process consulting. This inflexion point will clearly be higher for functionally simpler solutions, like CRM and lower for integrated business management systems, like NetSuite or SAP’s Business ByDesign.

Once you reach that inflexion point, you’re in a more interactive, lengthier sales process, and that’s typically face to face. At least that’s what we’re conditioned to: but it does not have to be that way. That will be the subject of another post – to come soon.

Update: Ben Kepes challenged #1 on his blog, and to some extent I have to agree. My post here is continuation of a discussion we started at the virtual SAP Marketing Community Meeting, and my mind-set was still business process software, e.g. CRM, ERP..etc, but I forgot to specify that. Instead of replicating the argument, why don’t you read my response to his response at Ben’s place.

TechMeme is great in threading together relevant posts, but is largely based (so I think…) on direct linking, so of course it could not auto-detect the ironic relationship between:

TechMeme is great in threading together relevant posts, but is largely based (so I think…) on direct linking, so of course it could not auto-detect the ironic relationship between:

Recent Comments