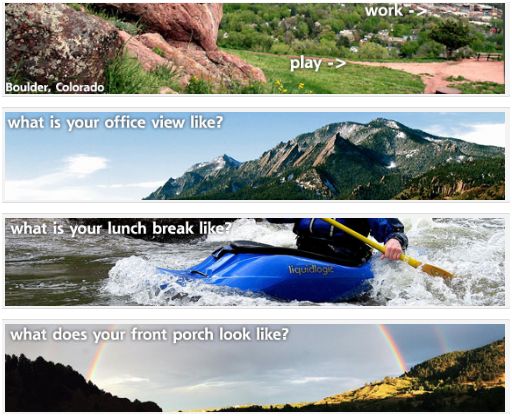

Now is a Great Time to Join or Found a Startup –says Bob Warfield, friend and fellow Enterprise Irregular.

Now is a Great Time to Join or Found a Startup –says Bob Warfield, friend and fellow Enterprise Irregular. - Now is a Terrible Time to Join or Found a Startup -says Charlie Wood, friend and fellow Enterprise Irregular.

Now what? Who is right? And the debate does not stop here, it sparked a pretty good discussion in the Enterprise Irregulars group. I think both sides are correct. It’s a Great Time and It’s a Terrible Time… read my take on CloudAve.

I’ve never particularly liked

I’ve never particularly liked ![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/54e6a3db43b098ecbf5db09e027cb1c1.png)

)

)

Fincancial crisis or not, VC investments did not entirely disappear, it’s just getting increasingly difficult to get funded. But VCs are still on the lookout, and as proof I’ll be moderating another

Fincancial crisis or not, VC investments did not entirely disappear, it’s just getting increasingly difficult to get funded. But VCs are still on the lookout, and as proof I’ll be moderating another

I don’t claim to be an expert economist, so

I don’t claim to be an expert economist, so ![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/1e888c58c2f8097a76d183db620f05dd.png)

We can argue all we want about the benefits of SaaS, discuss hypothetical use cases at length, but the best showcases are served up by real life, often unexpectedly.

We can argue all we want about the benefits of SaaS, discuss hypothetical use cases at length, but the best showcases are served up by real life, often unexpectedly.

Recent Comments