I’ve previously covered Netbooks, provider of an Integrated SaaS Business Suite for Very Small Businesses.

I’ve previously covered Netbooks, provider of an Integrated SaaS Business Suite for Very Small Businesses.

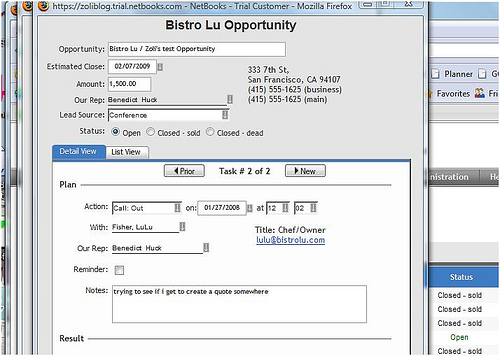

The company had an affordable On-Demand integrated business management solution for the VSB – very small businesses, the “S” in SMB / SME: typically companies with less then 25 employees, sometimes only 3-5, and, most importantly, without professional IT support, in which case Software as a Service is a life-saver.

NetBooks tried to cover a complete business cycle, from opportunity through sales, manufacturing, inventory / warehouse management, shipping, billing, accounting – some with more success then others. The process logic, the flow between various functional areas was excellent, but it was rendered almost unusable by a horrible UI. And it didn’t scale… so the company disappeared for a long year, completely re-building their code base.

Read on …

I don’t claim to be an expert economist, so

I don’t claim to be an expert economist, so ![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/1e888c58c2f8097a76d183db620f05dd.png)

.

.

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Recent Comments