I’m sure as hell lucky to have bet on Mint when Microsoft Money died… but to be honest it was a flip of a coin decision, Wesabe, the other web-based personal finance management program looked just as attractive. Good product, perfect pedigre, strong VC funding. Now Wesabe is in the deadpool while Mint essentially became Quicken Online.

I’m sure as hell lucky to have bet on Mint when Microsoft Money died… but to be honest it was a flip of a coin decision, Wesabe, the other web-based personal finance management program looked just as attractive. Good product, perfect pedigre, strong VC funding. Now Wesabe is in the deadpool while Mint essentially became Quicken Online.

A comparative analysis of the two, and why one died why the other thrives would be a very educational startup story – if somebody close enough to the fire has the facts.

Wesabe users have until July 31st to export their data (a rather short period, if you ask me, given the importance of such data.). I certainly hope Mint (Intuit) will step up the plate and offer streamlined migration.

In the meantime, I’m just lucky having bet on Mint. 🙂

(Cross-posted @ CloudAve)

An era comes to an end on June 30th, when

An era comes to an end on June 30th, when  You’d think at least Microsoft’s own products are compatible with Vista. Well, sort of. MS Money users who converted from Quicken may be out of luck.

You’d think at least Microsoft’s own products are compatible with Vista. Well, sort of. MS Money users who converted from Quicken may be out of luck.

My poor experience was with MS Money 2007, but with Money Plus, the 2008 version of the product line Microsoft shows true ignorance to users’ legacy data needs. Money Plus comes in four editions: Essentials, Deluxe, Premium, and Home & Business.

My poor experience was with MS Money 2007, but with Money Plus, the 2008 version of the product line Microsoft shows true ignorance to users’ legacy data needs. Money Plus comes in four editions: Essentials, Deluxe, Premium, and Home & Business.

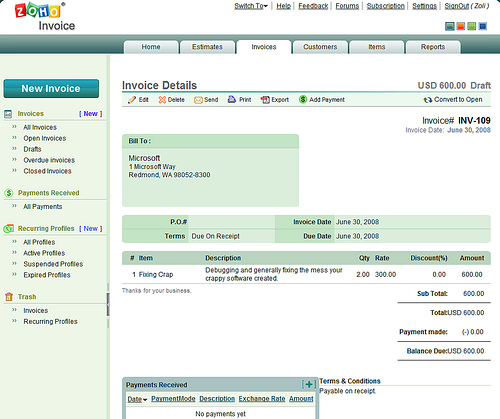

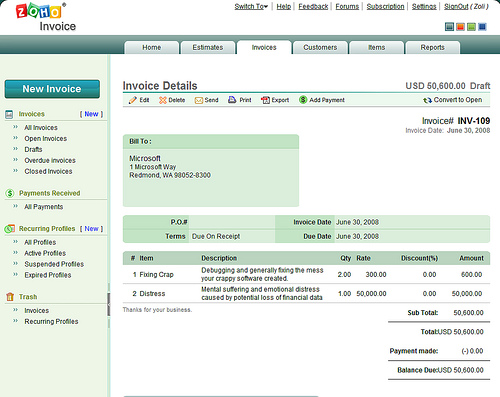

) and not even feel the need to apologize. It’s the absolute Cardinal Sin. And now this company wants me to put my trust in their services?

) and not even feel the need to apologize. It’s the absolute Cardinal Sin. And now this company wants me to put my trust in their services?

Recent Comments