I guess I should start theme days. Yesterday it was passwords, today it’s a picture is worth a thousand words. Well, this time it’s actually 4 images, but they tell the full story.. no comment required.

New Blog Post: Check Out the NEW NetSuite Compete Site!: check out the new NetSuite compete site for competitive… http://twurl.nl/0h2gyj

OK, I am clicking through.. only to find this:

What’s this? Obstacle course? hm… click through again…

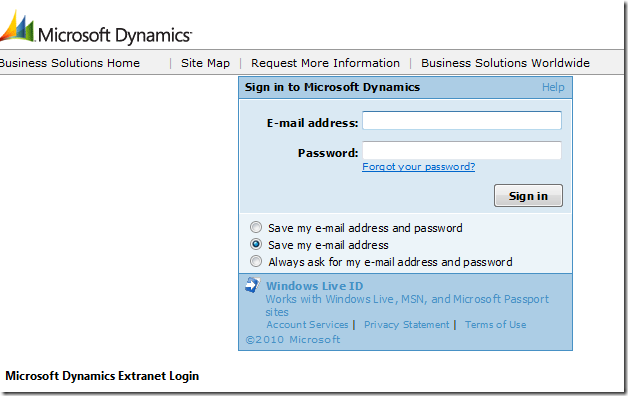

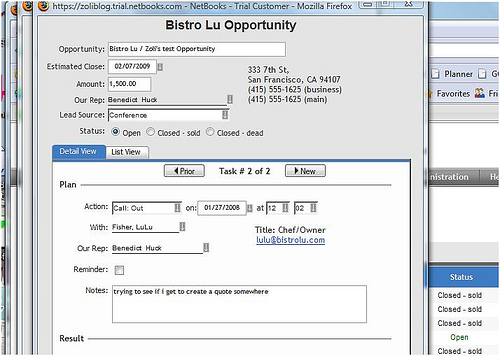

Geez, will this ever end? Click… click..

No way, Jose. I’m so outta here. #FAIL.

Update: On second thought, I think Microsoft must have a penchant for Obstacle Courses – here’s another one.

(Cross-posted @ CloudAve)

) for his crusade against bloated integration and maintenance costs, which “can make up 70 to 90% of TCO in an SAP shop” and Ray also has a track record of

) for his crusade against bloated integration and maintenance costs, which “can make up 70 to 90% of TCO in an SAP shop” and Ray also has a track record of

![Reblog this post [with Zemanta]](https://www.zoliblog.com/wp-content/uploads/HLIC/54e6a3db43b098ecbf5db09e027cb1c1.png)

I’ve previously covered Netbooks, provider of an

I’ve previously covered Netbooks, provider of an  Ben recently reported on how

Ben recently reported on how

Recent Comments