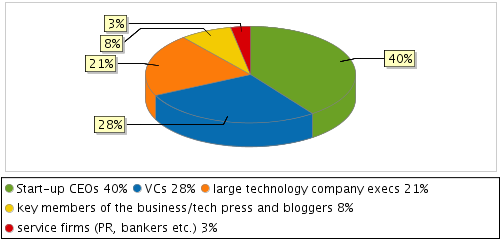

Venture capitalists have been pouring money into “clean technology” companies – $2.2 billion in 2007, an increase of 46% over 2006. Why are VCs making so many long-term, capital-intensive bets? Which technologies will be world-changing, and which will be duds?

Venture capitalists have been pouring money into “clean technology” companies – $2.2 billion in 2007, an increase of 46% over 2006. Why are VCs making so many long-term, capital-intensive bets? Which technologies will be world-changing, and which will be duds?

In living proof that there is life outside the Palo Alto / Menlo Park proximity, SVASE will host a VC Panel on investing in Green Tech tomorrow at the Crow Canyon Country Club, in Danville, CA. (A very green venue for a Green Event

In living proof that there is life outside the Palo Alto / Menlo Park proximity, SVASE will host a VC Panel on investing in Green Tech tomorrow at the Crow Canyon Country Club, in Danville, CA. (A very green venue for a Green Event ).

).

The panelists are:

- Marianne Wu, Partner, Mohr Davidow Ventures

- J. Christopher Moran, Vice President, General Manager, Applied Ventures

- Paul Chau, Partner, WI Harper

- Peter Henig, Managing Partner, Greenhouse Capital Partners

- Mark Harris, Relationship Manager, Silicon Valley Bank

Agenda:

6-6:30 pm: Networking and Hors D’oeuvres

6:30-8 pm: Panel discussion and Q/A

For details see the SVASE site, or head straight to registration.

See you there!

It did not completely die though: Cliff Shaw’s next startup,

It did not completely die though: Cliff Shaw’s next startup,  “Meet again”: Cliff does not talk about his next gig yet, but his

“Meet again”: Cliff does not talk about his next gig yet, but his

I’ve pretty much said everything there is to say about

I’ve pretty much said everything there is to say about

Cambrian House, the poster-boys of Crowdsourcing are essentially dead – assets being sold in a garage sale for a fraction of what investors put in.

Cambrian House, the poster-boys of Crowdsourcing are essentially dead – assets being sold in a garage sale for a fraction of what investors put in.

This year’s

This year’s  .

. After a long break I’ll be moderating another

After a long break I’ll be moderating another  Under the Radar is the Silicon Valley’s most established startup debut platform: a conference series organized by

Under the Radar is the Silicon Valley’s most established startup debut platform: a conference series organized by

Recent Comments