Zoho, best known for their Web-based Productivity (Office+) Suite today released Zoho People, a feature-rich On-Demand HRMS – Human Resources Management System. For the product introduction please read my previous post, while here I focus on business analysis, specifically on what this move means to software sales in general.

Zoho, best known for their Web-based Productivity (Office+) Suite today released Zoho People, a feature-rich On-Demand HRMS – Human Resources Management System. For the product introduction please read my previous post, while here I focus on business analysis, specifically on what this move means to software sales in general.

Today’s product announcement signifies a departure from what Zoho has been known for so far, in a number of ways. Their primary reputation is being the best Web-based Office / Productivity Suite provider – People is clearly a process-driven, transactional system with “enterprisey” features: organization levels, work-flow, permissions…etc.

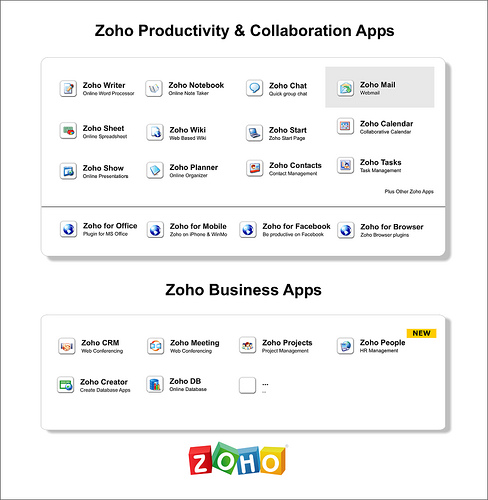

It’s not an entirely new field for Zoho though, as their CRM solution has been gaining traction for years now – both in terms of new customers as well as converts from the market leader. (See chart with full list of Productivity and Business Apps). As a matter of fact, I’ve often stated calling it CRM is an understatement: with Sales Order Management, Procurement, Inventory Management, Invoicing it’s really more of a mini-ERP. Add to it Accounting and HCM and Zoho can come up with an unparalleled Small Business Suite, which includes the productivity suite (what we now consider the Office Suite) and all process-driven, transactional systems: something like NetSuite + Microsoft, targeted at SMB’s, perfectly rhyming with Zoho’s stated objective of becoming the outsourced IT for small businesses.

Except… well, Zoho People is not a small business system. All you have to do is look at some of the organizational setup, or processes, like holiday, training, leave requests, company policies to realize that this system is ideally suitable for organizations with a few hundred employees and more. (The “M” in SMB, whereas most of Zoho’s focus has been on the “S” until now). So it’s a departure from Zoho’s traditional target market, and by its very nature it’s not a system individuals or small groups would just start to use in an ad-hoc manner. It’s a system to be introduced by HR for the entire company.

Bringing an enterprise system to the market typically requires a different approach, a coordinated marketing and sales effort, supplemented by consulting and support – i.e. all the extra weight that makes enterprise software “big and fat”. Yet Zoho just throws it out in the open, like they did with Writer, Sheet or any one of the dozen or so productivity tools. They have no clue how to market enterprise software! – one might say… and do they, really?

Simply announcing enterprise software without marketing and sales is certainly a risky proposition. Any startup that does with their main product is doomed to fail. Yet Zoho can afford an experiment. The new HCM system is just one product in their portfolio, in fact the entire Zoho portfolio is just a big experiment of the parent company, privately held and profitable Adventnet. CEO Sridhar Vembu repeatedly stated his mission is to commoditize software, delivering it to large masses at previously unseen prices.

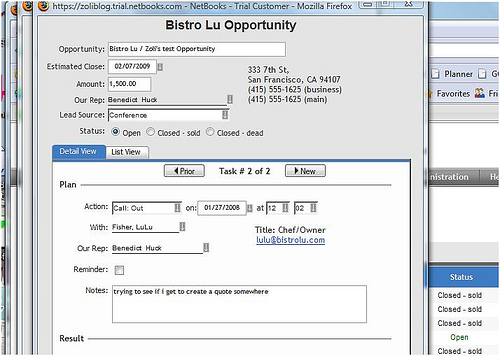

There’s all this talk about how SaaS changes the economics of Software – pull vs push process, try-and-buy vs. the expensive enterprise sales process; but it mostly refers to the SMB space. The try-and-buy, self-serve model is almost unheard of amongst larger organizations and more complex software. It traditionally needs more cajoling and hand-holding. But why not break away from tradition? Why should all innovation stay on the product side? Zoho goes the extra mile to make the new system more “consumable”: screenshot tours, demo videos abound. Of course disruptive pricing does not hurt, either.

If Zoho People fails to gain traction, so be it: the company will likely focus on their main avenue of becoming the IT provider for SMB’s, integrate features from People into Zoho Business and CRM, and figure out how to crack the HCM market later. If, however it starts gaining traction, it’s a good signal to the entire SaaS industry: an indication that transparency, online information and help works, the try-and-buy model may just be feasible even with larger organizations, which, for the first time will buy Software as a Service instead of being sold to by pushy enterprise sales teams.

(Disclaimer: I am an Advisor for Zoho.)

Related posts: Between the Lines, Zoho Blogs, Deal Architect, Centernetworks, Wired, SmoothSpan Blog, GeekZone, Webware, Venturebeat, Web Worker Daily, TechCrunch, Business Two Zero, Irregular Enterprise.

The belts will be tightened, says the

The belts will be tightened, says the  Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Recent Comments