This is a speculative post. As it is widely known, JotSpot, a very user-friendly wiki and application-platform-wannabe was acquired by Google in October 2006, only to be closed for new users for a long time. Existing users could continue to access their information free.

This is a speculative post. As it is widely known, JotSpot, a very user-friendly wiki and application-platform-wannabe was acquired by Google in October 2006, only to be closed for new users for a long time. Existing users could continue to access their information free.

There was a lot of speculation as to when it would re-surface and in what shape. I certainly liked the wiki before they “disappeared”, and was hoping The Goog would take the opportunity to do more than just re-label it and make it more scalable:

I hope that means they rethought everything and integrated JotSpot well into a number of offerings.

- It could provide for much better document management than the current Docs & Spreadsheets UI.

- It overlaps with Page Creator, also with the simplified version found in Google Groups – in fact Groups which is no longer just email lists but a rudimentary collaboration platform and JotSpot could very well be merged / integrated.

- Finally JotSpot tried to provide primitive applications (spreadsheet, calendar..etc) all of which have a better Google counterpart, so one would hope they will be replaced, too.

Perhaps we’re getting close to the re-emergence of JotSpot (yes, I know it won’t be called GSpot, but why not have some fun?). Obviously this is the speculative part, but several users report that JotSpot wikis disappear from the net. Users are understandably getting excited:

Is it over? Just like this? Without notice?

I just finished a major rework on the site. And 4 hours after it:

boom, it disappeared.Any help?

Where is all the data gone?

The main jot.com page displays a Network Solutions domain capture page.

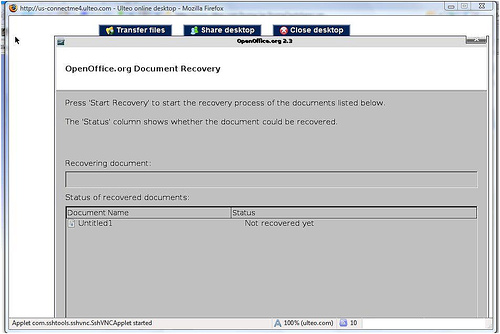

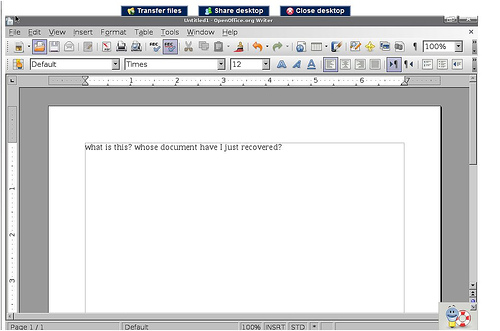

I can still access www.jot.com, which displays the standard notification about the Google transaction, and, more importantly I can get into my jot account using the direct URL: account.jot.com. I am using OpenDNS. Perhaps the difference is a matter of DNS propagation, and they are changing in preparation of the Google Wiki launch?

My previous coverage:

- JotSpot Google Deal – Who Wins, Why it’s Big:First Thoughts

- Losers of the Google / JotSpot Deal

- JotSpot…Gspot … Google Wiki

(Hat tip: Isaac Garcia, CEO of Central Desktop)

Update (2/6): Mashable list 14 of what they call Online Spreadsheet Applications (clearly, not all are) and surprise, surprise, JotSpot is one of them. That’s a joke. As much as Iiked JotSpot as a wiki, it failed to become an application platform, and it certainly isn’t (hasn’t been) a spreadsheet. Like I wrote before:

Just because a page looks like an application, it does not mean it really is. Try to import an Excel spreadsheet into a Jot Spreadsheet page, you’ll get a warning that it does not import formulas. Well, I’m sorry, but what else is there in a spreadsheet but formulas? The previous name, Tracker was fair: it’s a table where you track lists, but not a spreadsheet. (more)

But whatever we think of the former JotSpot Tracker capabilities, it’s hard to see it left intact once Google releases what they turned JotSpot into. Google themselves have a much better online spreadsheet, I certainly hope for their sake that they will integrate their apps with JotSpot, and kill off the overlap.

(FYI: The real online spreadsheets out of Mashable’s 14 are Google , Zoho, EditGrid, ThinkFree. )

The belts will be tightened, says the

The belts will be tightened, says the  Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

Yes, Dan is right, “Web/Enterprise 2.0 startups can’t get a hearing with CIOs and tech buyers at corporations” and their apps are not considered mission critical, but the whole point is that a lot of these Enterprise 2.0 tools are not sold at the CIO level.

After a long break I’ll be moderating another

After a long break I’ll be moderating another

Recent Comments