Under the Radar is the Silicon Valley’s most established startup debut platform: a conference series organized by Dealmaker Media, covering business applications, social media, entertainment, mobility..etc. The next conference, focusing on The Business of Web Apps: Where the Web Goes to Work is only two days away and Dealmaker Media allowed me to announce a few discounted tickets. Enjoy the $100 blogger discount by registering at this link only.

Under the Radar is the Silicon Valley’s most established startup debut platform: a conference series organized by Dealmaker Media, covering business applications, social media, entertainment, mobility..etc. The next conference, focusing on The Business of Web Apps: Where the Web Goes to Work is only two days away and Dealmaker Media allowed me to announce a few discounted tickets. Enjoy the $100 blogger discount by registering at this link only.

32 startups will present in a rapid-fire format (correction: American Idol format ) they are grouped in categories of 4 each, in two parallel tracks (yes, you do have to pick one, but can switch back and forth), and each presenter has about 15 minutes. They get grilled by the judges and audience, and at the end of the conference the winners of each category are announced.

) they are grouped in categories of 4 each, in two parallel tracks (yes, you do have to pick one, but can switch back and forth), and each presenter has about 15 minutes. They get grilled by the judges and audience, and at the end of the conference the winners of each category are announced.

The categories and the selected startups are:

| Track 1 | Track 2 |

| Business Calls | Virtualization |

| Get Aggregated | Manage Up |

| Happy Customers | Virtual Worker |

| Work Together | Marketing and Measurement |

Last year I was on the Selection Committee to the Under the Radar Office 2.0 event, and as such reviewed over a hundred companies / products. Obviously not all could make it, so I am especially pleased to see some of them on this year’s list. Of course the real measure of success is that several presenters have since received funding, gained significant brand recognition and customers. Some are back this year as Graduate Circle sponsors:

3Tera | Blogtronix | Clarizen | Longjump | Nirvanix | Q-layer | Smartsheet.com | Transera

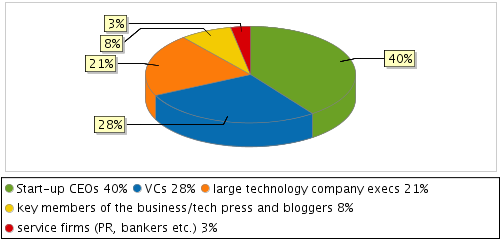

Other than the presentations, these events are also an excellent networking opportunity amongst the 400 or so attendees, so let’s look at the attendance statistics by provided by Dealmaker Media:

Concluding the Conference, Robert Scoble will be hosting a fireside chat with Amazon’s VP & CTO, Werner Vogels to discuss the future of apps in the cloud…where its heading, who will dominate and what you should be doing now to get ahead.

The event ends with a cocktail reception, and – here’s the bonus – participants are also invited to the Opening Reception the night before at Palo Alto’s Zibibbo.

So what are you waiting for? Grab a discounted ticked while they last.

Last, but not least, this year’s Selection Committee:

Pete Cashmore | Mashable

Robert Scoble | Scobleizer

Richard MacManus | ReadWriteWeb

Ismael Ghalimi | IT|Redux

Marshall Kirkpatrick | New Media Consultant

Josh Jaffe | Tech Confidential

Jon Burke | alarm:clock

Jeremy Toeman | Stage Two Consulting

Rafe Needleman | Webware

Leon Ho | Lifehack.org

Bryce T. Roberts | O’Reilly AlphaTech Ventures

Stowe Boyd | /Message

Brian Solis | bub.blicio.us

Rod Boothby | Innovation Creators

Eze Vidra | VC Cafe & Ask.com

Just done with the Your

Just done with the Your  Unless you’ve discovered a new

Unless you’ve discovered a new  I don’t expect their 20th employee to be just as passionate as the Founders, but it can’t be a 9-5 type person either. At this stage they still need driven Team Members, not simply employees.

I don’t expect their 20th employee to be just as passionate as the Founders, but it can’t be a 9-5 type person either. At this stage they still need driven Team Members, not simply employees.

For all my love and support of SVASE, I sometimes complain that the monthly “Main Events” are a bit cut-and-dry. Well, that will certainly not be the case tomorrow: star-power, money, frugality are all well represented on the panel discussing

For all my love and support of SVASE, I sometimes complain that the monthly “Main Events” are a bit cut-and-dry. Well, that will certainly not be the case tomorrow: star-power, money, frugality are all well represented on the panel discussing  Matt Mullenweg

Matt Mullenweg

The

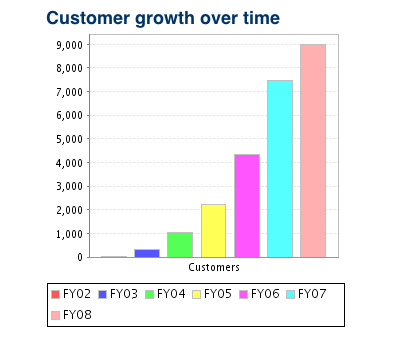

The  ) – but that’s typically in the context of Software as a Service, and in the SMB (small business) market. Atlassian’s products are mostly on-premise (although they now have a hosted version of Confluence) and their primary market is the large Enterprise. Yet they pulled off what amounts to a small miracle: essentially took the download.com, tucows style model we all know as consumers, and ported it to the enterprise space.

) – but that’s typically in the context of Software as a Service, and in the SMB (small business) market. Atlassian’s products are mostly on-premise (although they now have a hosted version of Confluence) and their primary market is the large Enterprise. Yet they pulled off what amounts to a small miracle: essentially took the download.com, tucows style model we all know as consumers, and ported it to the enterprise space.

So what is this culture like? Tough. When he doesn’t make his numbers, Atlassian President Jeffrey Walker is forced to make up for it as ticket-scalper on the street.

So what is this culture like? Tough. When he doesn’t make his numbers, Atlassian President Jeffrey Walker is forced to make up for it as ticket-scalper on the street.  OK, joke apart, this photo was shot last August, when the entire San Francisco office went to see a

OK, joke apart, this photo was shot last August, when the entire San Francisco office went to see a  ) I wonder when the San Francisco office will move into a winery… Perhaps

) I wonder when the San Francisco office will move into a winery… Perhaps  you get the picture by now: Working for Atlassian isn’t just a job – it’s a

you get the picture by now: Working for Atlassian isn’t just a job – it’s a  After a long break I’ll be moderating another

After a long break I’ll be moderating another

Recent Comments